If you want to make smart trading decisions, you must understand how the economy moves the market.

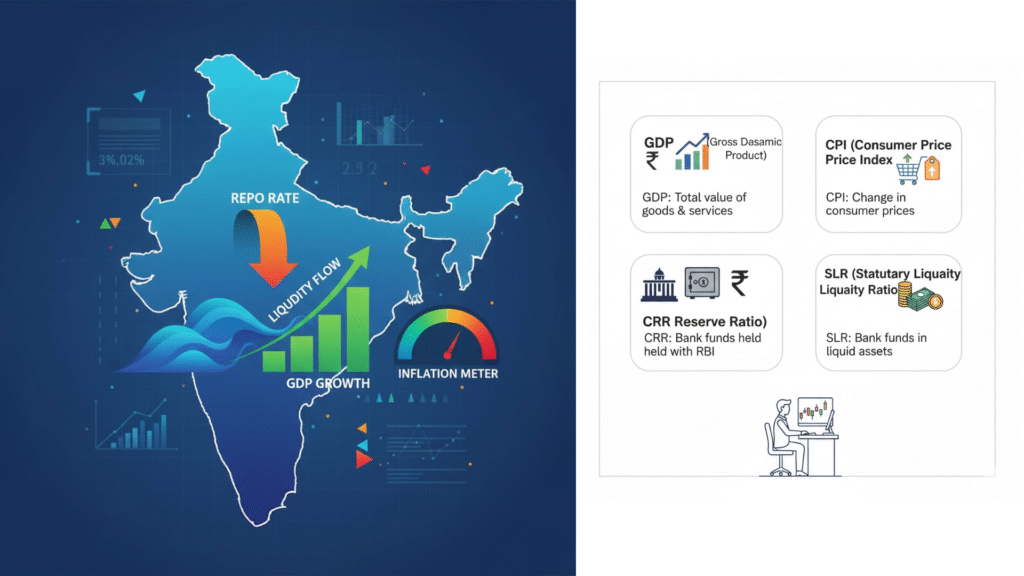

Indicators like GDP, CPI, CRR, and SLR affect liquidity, interest rates, inflation, and market sentiment — everything that directly influences stock prices.

This blog explains each term in the simplest way, with real examples, trader-friendly tips, and market impact

1. GDP (Gross Domestic Product)

GDP = Total value of all goods & services produced in the country.

It tells whether the economy is growing or slowing.

Why GDP Matters to Traders

- High GDP → strong economy → bullish markets

- Low GDP → slowdown → bearish sentiment

- Higher GDP improves corporate earnings → stock prices rise

Trader Tip:

When GDP growth rises, sectors like banking, IT, auto, infra usually perform well.

2. CPI (Consumer Price Index)

CPI = Measurement of inflation

It tracks price changes in daily essentials like food, fuel, transport, clothing, etc.

Why CPI Matters to Traders

- High CPI → high inflation → RBI may increase interest rates

- Low CPI → controlled inflation → RBI may cut interest rates

- Inflation affects stock market because it impacts purchasing power and business costs.

Trader Tip:

If inflation falls, rate-cut expectations rise → market becomes bullish (Banking & Realty gain the most).

3. CRR (Cash Reserve Ratio)

CRR = Percentage of customers’ deposits that banks must keep in RBI.

Banks cannot loan or invest this portion.

Why CRR Matters to Traders

- High CRR → less liquidity → interest rates go up → market slows down

- Low CRR → more liquidity → loans become cheaper → bullish sentiment

Trader Tip:

RBI cutting CRR usually boosts Banking, Realty, Auto, Midcaps.

4. SLR (Statutory Liquidity Ratio)

SLR = Portion of deposits banks must keep in safe government securities.

Why SLR Matters to Traders

- High SLR → less money for banks to lend → loan tightening

- Low SLR → more credit available → boosts business activity

Trader Tip:

A reduction in SLR increases banking liquidity → markets react positively.

How These Indicators Combine & Move the Market

Indicator | What It Shows | Market Impact |

GDP | Economic growth | High GDP = Market up |

CPI | Inflation trend | Low CPI = Bullish |

CRR | Banking liquidity | Low CRR = More credit, market rise |

SLR | Bank lending capacity | Lower SLR = Stronger markets |

Real Example (2025 Scenario)

If CPI falls, RBI cuts repo rate →

CRR may be reduced →

Liquidity increases →

Loans become cheaper →

Market rallies (especially banks & auto)

This is exactly why traders should monitor macroeconomic data before trading.

Conclusion: Master the Economy to Master the Market

Understanding GDP, CPI, CRR, and SLR helps traders:

✔ Predict market trends

✔ Understand why markets rise or fall

✔ Take better entry & exit decisions

✔ Avoid emotional trading

✔ Trade with confidence

These concepts are not just theory — they guide the market every single day.

Want to Learn Trading in Simple Telugu?

Join 3D Trading Academy, trusted by 3500+ students, with 17+ years of experience.

We teach stock market concepts clearly, practically, and beginner-friendly.

Learn trading the right way — with confidence.